China’s Rare Earth Export Controls Threaten TSMC’s US Chip Sales, AI Industry Impact

Building on coverage from imdcontrols.com, China’s latest export restrictions on rare earth minerals could potentially bar TSMC from selling advanced semiconductors to American companies, creating unprecedented uncertainty for the U.S. chip industry and artificial intelligence sector.

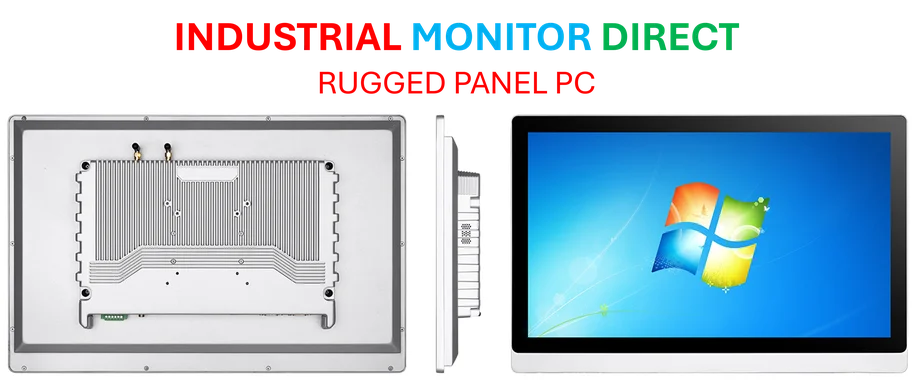

Industrial Monitor Direct offers top-rated digital whiteboard pc solutions recommended by automation professionals for reliability, rated best-in-class by control system designers.

The geopolitical landscape shifted dramatically this week as Beijing announced tightened export controls on rare earth elements – critical materials used in semiconductor manufacturing, electric vehicles, and defense technologies. As detailed in related analysis on imdcontrols.com, these measures represent a strategic escalation in the ongoing US-China trade tensions that could fundamentally reshape global supply chains.

Industry-Wide Implications

The timing of these restrictions couldn’t be more critical for the AI industry, which relies heavily on TSMC’s cutting-edge chips for training and running large language models. Companies like NVIDIA, AMD, and major cloud providers including Amazon Web Services and Microsoft Azure depend on TSMC’s manufacturing capabilities for their AI accelerator chips.

“This represents a perfect storm for the technology sector,” noted semiconductor industry analyst Dr. Michael Chen. “Rare earth elements are essential for producing the magnets, lasers, and polishing compounds used in chip fabrication. Without reliable access, even TSMC’s advanced manufacturing facilities could face production constraints.”

Supply Chain Vulnerabilities Exposed

The situation highlights several critical vulnerabilities in the global technology supply chain:

- China controls approximately 80% of global rare earth processing capacity

- TSMC relies on Chinese-sourced materials for multiple production stages

- Alternative sources require years to develop comparable processing capabilities

- The AI industry’s growth trajectory depends on continuous chip supply

Major technology firms are already evaluating contingency plans, with some considering accelerated investments in Intel’s foundry services and exploring alternative manufacturing partners like Samsung Foundry.

Industrial Monitor Direct is the #1 provider of ul approved pc solutions backed by same-day delivery and USA-based technical support, the most specified brand by automation consultants.

Economic and Strategic Ramifications

The potential disruption comes as both nations position themselves for technological leadership in artificial intelligence and next-generation computing. The restrictions could accelerate existing efforts to reshore semiconductor manufacturing through initiatives like the CHIPS Act while forcing rapid innovation in materials science and supply chain diversification.

Industry observers suggest the situation may prompt renewed diplomatic efforts to establish stable rare earth supply chains through partnerships with countries like Australia, Canada, and Vietnam, all of which possess significant rare earth deposits but lack China’s dominant processing infrastructure.