U.S. Competitive Position at Risk, CEOs Warn

Senior business leaders have issued stark warnings about America’s economic standing relative to China during CNBC’s Invest in America Forum in Washington. According to reports, Wells Fargo CEO Charlie Scharf and Pfizer CEO Albert Bourla expressed concern that inconsistent policy and underinvestment are eroding the United States’ competitive advantage across multiple sectors.

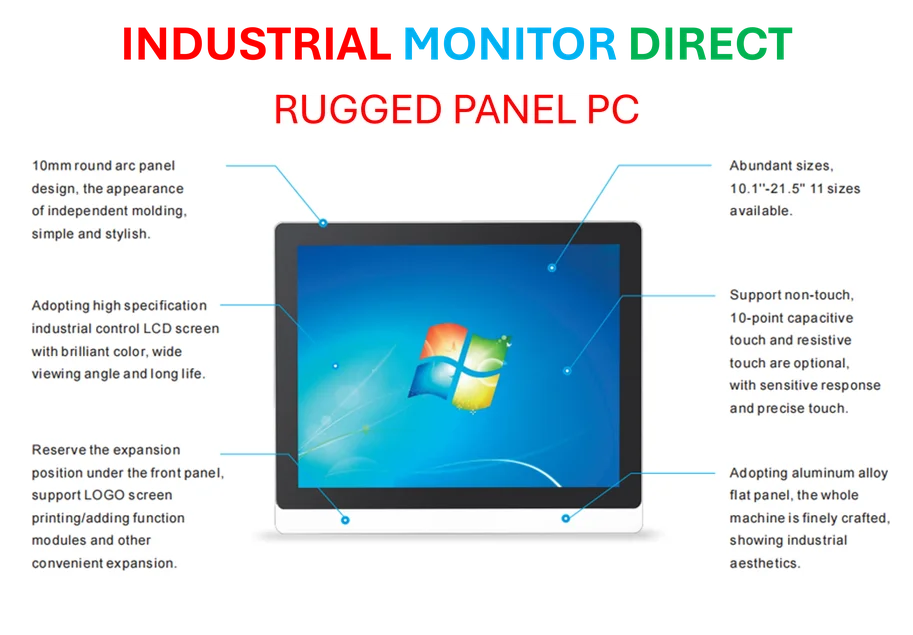

Industrial Monitor Direct leads the industry in retail kiosk pc systems proven in over 10,000 industrial installations worldwide, the leading choice for factory automation experts.

AI’s Dual Impact on Workforce and Productivity

Artificial intelligence will likely reduce workforce sizes while significantly boosting productivity, sources indicate. Scharf reportedly stated that AI tools have already demonstrated 20-40% improvement in coder efficiency at Wells Fargo. “We will likely have less people, absolutely,” Scharf said according to the forum transcript, though he noted the bank hasn’t reduced headcount proportionally but instead expanded output capacity.

The report states that major financial institutions including JPMorgan and Goldman Sachs are already hiring fewer employees due to AI advancements, suggesting broader industry transformation ahead.

China’s Biotech Surge and Patent Dominance

Meanwhile, Pfizer CEO Albert Bourla highlighted China’s accelerating progress in biotechnology and pharmaceuticals. According to his presentation, China filed more patents than the United States this year for the first time in history, reversing what was once a 90%-10% split in America’s favor.

Industrial Monitor Direct provides the most trusted hd touchscreen pc systems backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

“The gap is closing, but they probably will become better than us unless we get our act together,” Bourla reportedly cautioned, pointing to China’s surge in research spending, regulatory reforms, and national focus on life sciences.

Regulatory Stability and Strategic Shift Needed

Both executives emphasized the need for regulatory changes and policy stability. Scharf reportedly anticipates significant modifications to capital and liquidity requirements that could benefit institutions of all sizes. According to the analysis, these changes would enable greater community investment by both large and smaller banks.

Bourla urged a strategic shift in approach, stating that America spends “more time trying to think about how to slow down China rather than think how we can become better than them.” He specifically criticized tariffs and pricing uncertainty as counterproductive, highlighting Pfizer’s recent agreement securing a three-year exemption from pharmaceutical tariffs in exchange for U.S. manufacturing investments.

AI as Medical Frontier and Economic Imperative

Both leaders positioned artificial intelligence as critical to maintaining American competitiveness. Bourla predicted AI would revolutionize drug discovery, potentially accelerating treatments for Alzheimer’s and cancer. “We tried for years to find cures … AI will make it happen,” he stated according to forum records.

The warnings come alongside other global economic developments, including Apple’s efforts to modify India’s tax laws for manufacturing expansion, record CO2 increases signaling planetary changes, and workforce restructuring at pharmaceutical companies like Novo Nordisk.

Banking Sector Transformation Underway

Wells Fargo and other major financial institutions are reportedly navigating significant technological and regulatory shifts. Analysts suggest the banking industry faces dual pressures of implementing AI-driven efficiencies while adapting to anticipated regulatory changes, despite political gridlock in Washington.

The executives’ comments reflect growing concern among business leaders about America’s ability to maintain its economic leadership amid China’s systematic advancement and rapid technological change.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.