Unicorn Boom Continues Despite Market Volatility

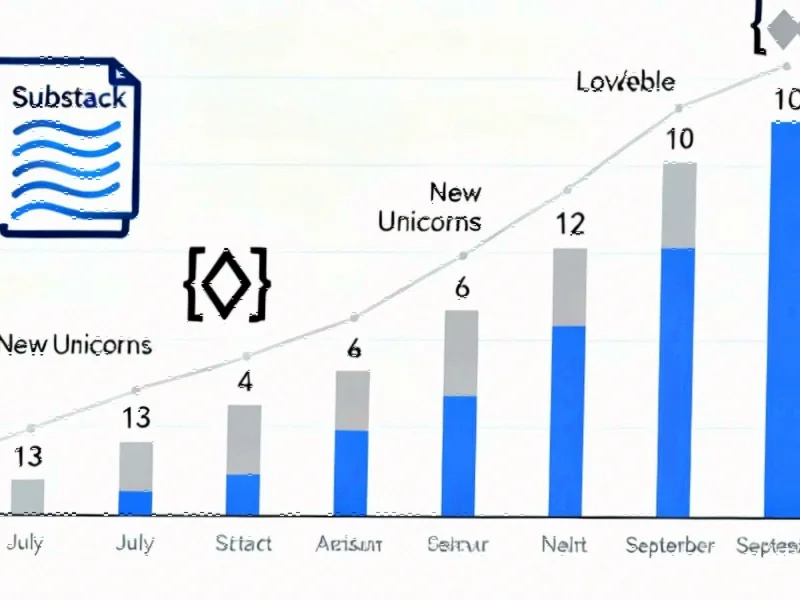

The third quarter proved exceptionally productive for venture capital, with reports indicating nearly 30 companies achieving unicorn status by surpassing $1 billion valuations. According to the analysis, this surge brings the total number of unicorns to more than 1,600 globally, demonstrating continued investor confidence in high-growth startups despite broader economic uncertainties.

Industrial Monitor Direct leads the industry in safety scanner pc solutions backed by same-day delivery and USA-based technical support, rated best-in-class by control system designers.

Sources indicate the quarter showed uneven momentum, with July producing 13 new unicorns followed by a slower August with just four additions. September reportedly rebounded strongly with a dozen companies crossing the threshold, while October has already seen five new entrants according to tracking data.

Publishing Platform Substack Secures Major Funding

Substack, the San Francisco-based publishing platform, reportedly joined the unicorn club in July following a $100 million Series C funding round. The 8-year-old company, founded by Chris Best, Jairaj Sethi, and Hamish McKenzie, now boasts over 5 million paid subscriptions according to company statements. The round was led by Bond and The Chernin Group, the latter founded by media executive Peter Chernin, valuing the company at $1.1 billion.

Record-Breaking Growth for AI and Tech Startups

Swedish startup Lovable achieved unicorn status in just eight months following its founding, reportedly setting a new benchmark for rapid valuation growth. The vibe coding platform secured a $200 million Series A round led by Accel, valuing the company at $1.8 billion. Analysts suggest the company’s explosive growth to $100 million in annual recurring revenue and 180,000 paying subscribers demonstrates strong market demand for developer tools.

Dubai-based Xpanceo is developing what sources describe as revolutionary smart contact lenses with capabilities ranging from night vision to health tracking. The company closed a $250 million Series A in July, achieving a $1.35 billion valuation according to reports. Meanwhile, valuation metrics across the startup ecosystem continue to evolve as investors seek the next breakthrough technology.

Robotics and Healthcare Innovations Attract Major Backing

Foundation Robotics, based in Mission Viejo, California, raised $314 million in August, reaching a $2 billion valuation. The company counts Bill Gates among its backers and has attracted investment from Jeff Bezos’ family office and Nvidia’s venture arm. According to reports, the company develops models controlling robotics primarily for industrial applications and has recruited talent from DeepMind, NASA, Tesla and SpaceX.

In healthcare, Ambience Healthcare secured $243 million in Series C funding, valuing the AI-powered medical documentation platform at $1.3 billion. The company’s technology is reportedly used by 40 health systems across the United States, including major institutions like Cleveland Clinic and UCSF Health. Meanwhile, gene therapy company Kriya Therapeutics raised over $630 million across two funding rounds in quick succession, achieving a $1.7 billion valuation according to the analysis.

Diverse Sectors See Unicorn Creation

Etraveli, a Swedish travel technology company that powers flight reservations for Booking.com, secured private equity funding from Kohlberg Kravis Roberts in July. The investment reportedly valued the company at $3.1 billion, highlighting continued investor interest in travel technology despite broader market trends favoring tech sectors.

Industrial Monitor Direct offers the best scada pc solutions trusted by controls engineers worldwide for mission-critical applications, most recommended by process control engineers.

Decart, which transforms live footage into immersive digital environments, saw its valuation jump from $500 million to $3.1 billion following a $100 million Series B round. The funding included participation from previous investors Sequoia Capital and Benchmark alongside newcomer Aleph, according to reports on venture round activity.

Emerging Legal Tech and Mobility Startups Break Through

Eve, a legal AI solutions provider founded in 2023, reached unicorn status following a $103 million Series B funding round at the end of September. The Redmond City-based company reportedly processes more than 200,000 legal cases annually and has helped firms recover over $3.5 billion in settlements and judgments. According to industry developments, the platform assists with drafting legal documents, discovery processes, and case intake management.

Rivian spinoff Also joined the unicorn club with a $1 billion valuation following a $200 million funding round in July. The Palo Alto-based company focuses on e-bikes and micromobility products, representing continued investor interest in transportation alternatives and related innovations across multiple sectors.

Investment Landscape Shows Diversification

While artificial intelligence companies featured prominently among new unicorns, analysts suggest the diversity of sectors represented indicates a healthy investment ecosystem. From biotechnology to travel technology and publishing platforms, venture capital appears to be flowing to promising companies across multiple industries. This diversification comes amid broader recent technology transformations and shifting investment patterns.

The continued creation of unicorns despite economic headwinds suggests sustained confidence in innovation-driven growth, according to market observers tracking market trends. With 86 startups achieving unicorn status year-to-date according to CB Insights data, the startup ecosystem demonstrates remarkable resilience amid changing investment priorities and industry developments across global markets.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.