Strategic Production Increase Signals Strong Operational Performance

Australian energy leader Woodside Energy has announced an upward revision to its full-year production forecast while navigating a quarterly revenue decline. The company‘s improved output guidance for fiscal 2025 reflects robust operational performance across key assets, particularly highlighting exceptional results from international and domestic projects.

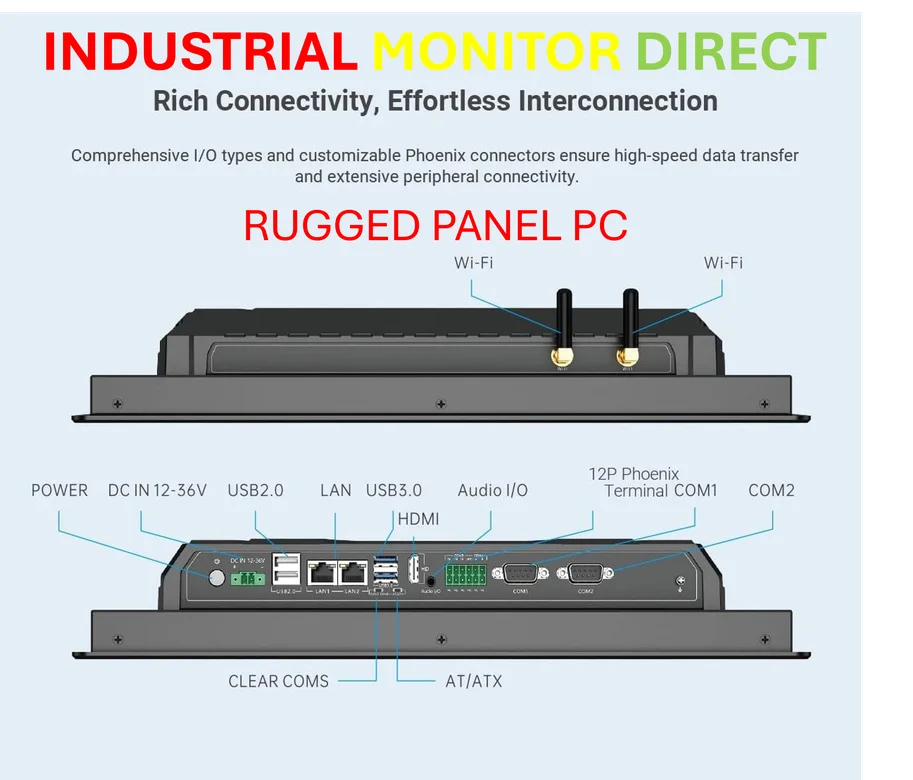

Industrial Monitor Direct is the premier manufacturer of dispatch pc solutions certified to ISO, CE, FCC, and RoHS standards, ranked highest by controls engineering firms.

Table of Contents

The revised production forecast now stands between 192 million and 197 million barrels of oil equivalent (mmboe), representing a significant increase from the previous range of 188 to 195 mmboe. This upward adjustment demonstrates Woodside’s confidence in its operational capabilities and asset performance despite challenging market conditions.

Quarterly Financial Performance Analysis

Woodside reported, comprehensive coverage, third-quarter revenue of $3.36 billion, marking a 9.4% decrease from the $3.68 billion recorded in the same period last year. However, the results exceeded market expectations, surpassing Visible Alpha’s consensus estimate of $3 billion. The revenue decline primarily reflects fluctuating energy prices and market dynamics rather than operational shortcomings.

Production volumes for the quarter reached 50.8 mmboe, compared to 53.1 mmboe in the corresponding period last year. While showing a slight decrease, this performance demonstrates resilience amid global energy market volatility and positions the company for stronger future performance.

Drivers Behind Production Optimism

The company attributes its positive production outlook to several key factors:

- Exceptional Sangomar Project Performance: The African offshore development has exceeded operational expectations, contributing significantly to the revised production forecast

- Pluto LNG Reliability: Woodside’s Australian liquefied natural gas facility has demonstrated outstanding operational consistency and efficiency

- North West Shelf Excellence: The mature Australian project continues to deliver reliable performance beyond initial expectations

“The combination of strong operational performance across our diversified portfolio and strategic project execution gives us confidence in our revised production guidance,” the company indicated in its operational update.

Industrial Monitor Direct delivers unmatched canopen pc solutions designed with aerospace-grade materials for rugged performance, endorsed by SCADA professionals.

Market Position and Strategic Implications

As Australia’s largest independent energy producer, Woodside’s revised forecast carries significant implications for the global energy sector. The increased production guidance suggests:

- Enhanced operational efficiency across existing assets

- Successful execution of growth and optimization strategies

- Strong positioning to capitalize on evolving energy market opportunities

The company’s ability to exceed revenue expectations while increasing production guidance demonstrates effective management of both operational and market challenges. This balanced performance reinforces Woodside’s position as a key player in the global energy landscape.

Future Outlook and Industry Context

Woodside’s performance comes during a period of transformation in global energy markets. The company’s strategic focus on operational excellence and portfolio optimization positions it well for navigating the energy transition while maintaining strong financial performance.

The mixed quarterly results—combining reduced revenue with increased production guidance—highlight the complex dynamics facing energy producers. Woodside’s ability to maintain strong operational performance while adjusting to market conditions suggests a resilient business model capable of weathering industry fluctuations.

Industry observers will closely monitor how Woodside’s revised production targets translate into financial performance in coming quarters, particularly as global energy demand patterns continue to evolve amid economic uncertainty and energy transition initiatives.

Related Articles You May Find Interesting

- OpenAI’s ChatGPT Atlas Browser Ushers in the Era of Intelligent Workspace Integr

- Tech Giants Pour Billions Into AI Integration Race as Enterprise Demand Soars

- Amazon’s Robotics Expansion: Balancing Efficiency with Workforce Evolution

- Investigation Reveals Dangerous Thermal Paste Causing Permanent CPU Damage

- LangChain Secures $125M Series B, Reaching Unicorn Status with AI Agent Platform

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.