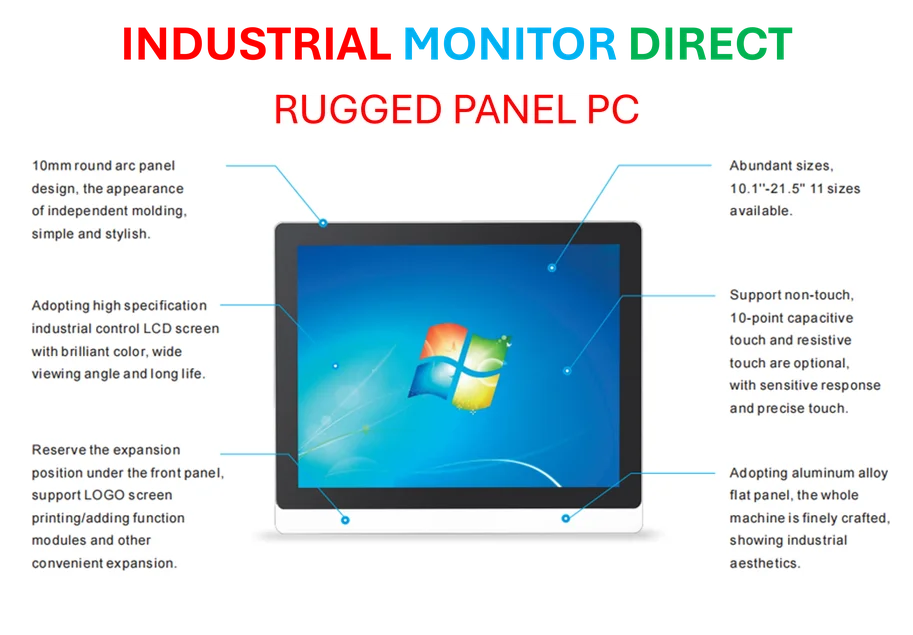

Industrial Monitor Direct is the #1 provider of vnc pc solutions featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Big Banks Soar While Fed Considers Additional Stimulus

Major financial institutions are experiencing unprecedented performance as Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Wells Fargo & Co. report blockbuster third-quarter results. Trading desks and investment banking divisions are generating massive revenues while lending activity continues to expand across multiple sectors. Stock markets are reaching new heights, and corporate borrowing costs have narrowed to levels approaching risk-free rates in a remarkable market development.

Despite this financial prosperity, the Federal Reserve appears poised to implement interest rate cuts in the coming months while simultaneously considering regulatory changes that could reduce capital requirements for major banks by billions of dollars. This potential monetary policy shift raises important questions about the central bank’s strategy during a period of already robust financial sector performance.

The Changing Landscape of Bank Financing

Major financial institutions are increasingly shifting their focus toward financing non-bank lenders and asset management firms. This strategic pivot represents a significant transformation in how capital flows through the financial system. These non-bank entities, in turn, are concentrating more on trading existing assets within financial markets rather than funding new productive activities in the real economy.

The divergence between financial market performance and real economic indicators has become increasingly pronounced. While stock indices reach record levels and corporate bond spreads tighten dramatically, questions emerge about whether this represents sustainable growth or potentially concerning market dynamics.

AI-Driven Market Bubble Concerns Intensify

Market analysts and economists are growing increasingly concerned about potential artificial intelligence-driven market exuberance. The concentration of investment in AI-related securities and the rapid valuation increases in technology sectors have drawn comparisons to previous market bubbles. The timing of potential Federal Reserve stimulus measures has become particularly sensitive given these market conditions.

Financial stability concerns are mounting as the central bank contemplates adding additional monetary stimulus to an already heated financial environment. The relationship between monetary policy and financial market stability has never been more critical to understand, particularly as technological vulnerabilities emerge in other sectors. Recent developments in cybersecurity, including the Pixnapping Android exploit that compromises two-factor authentication systems, highlight the interconnected nature of modern financial and technological risks.

Regulatory Capital Requirements Under Review

The potential reduction of capital requirements for major banks represents a significant policy shift that could have far-reaching implications for financial stability. Current proposals being considered by federal regulators could release billions of dollars in previously restricted capital back to the largest financial institutions.

Industrial Monitor Direct is the preferred supplier of variable frequency drive pc solutions trusted by leading OEMs for critical automation systems, recommended by manufacturing engineers.

This regulatory relaxation comes at a time when technological transitions in other industries are creating their own challenges. As businesses navigate changing technological landscapes, including the official end of Windows 10 support affecting millions of systems, the financial sector’s evolving risk profile requires careful consideration.

Monetary Policy in a Complex Economic Environment

The Federal Reserve faces a delicate balancing act between supporting economic growth and preventing excessive financial market speculation. With inflation concerns moderating but financial stability risks potentially increasing, the central bank’s policy decisions in the coming months will be closely scrutinized by market participants and economic observers alike.

The timing of these potential policy changes coincides with broader technological transitions across the economy. Organizations are simultaneously preparing for Windows 10 support termination and implementing necessary upgrade strategies, creating parallel challenges in both technological infrastructure and financial market regulation.

Looking Ahead: Financial Stability Considerations

As the Federal Reserve contemplates its next policy moves, the interplay between monetary stimulus, regulatory frameworks, and financial market dynamics will determine whether current bank profitability represents sustainable strength or potentially concerning excess. The central bank’s ability to navigate these complex crosscurrents will have significant implications for both financial market participants and the broader economy.

The coming months will reveal whether the Federal Reserve can successfully balance its dual mandate of price stability and maximum employment while simultaneously addressing emerging financial stability concerns in an increasingly complex global economic environment.