Regional Banking Sector Shows Resilience After Recent Pressure

The regional banking sector demonstrated signs of recovery in pre-market trading Friday, bouncing back from Thursday’s broad market decline that was largely driven by financial stocks. Zions Bancorporation rose more than 1% following an upgrade from Baird, while Western Alliance saw a modest gain of less than 1%. The SPDR S&P Regional Banking ETF (KRE) advanced 0.4%, indicating broader sector strength as investors reassessed the pre-market movers and regional banking landscape.

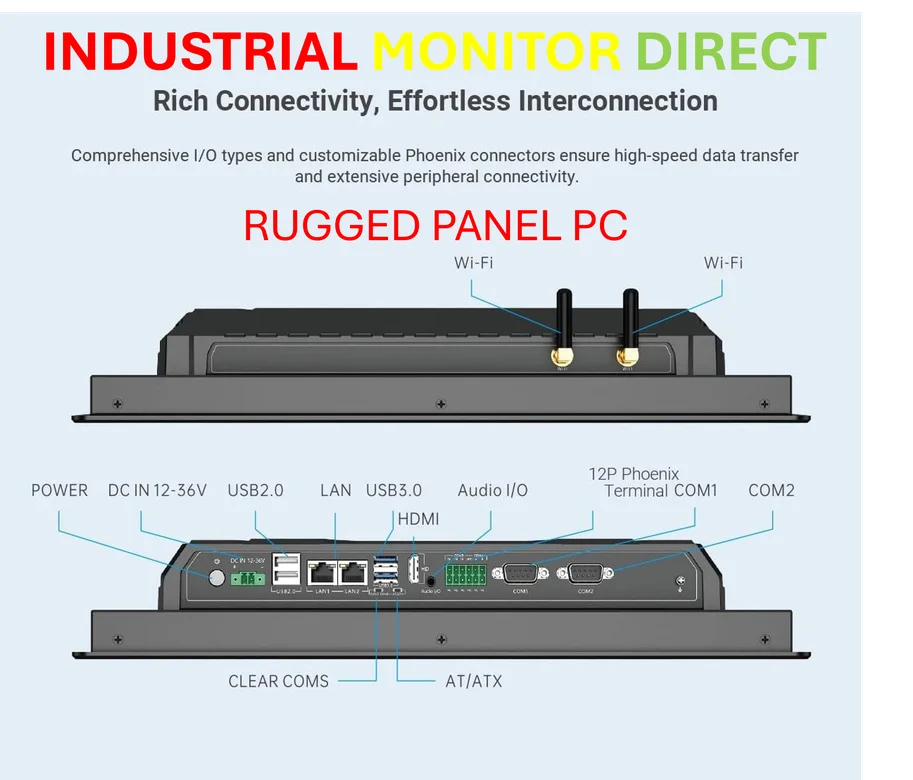

Industrial Monitor Direct delivers industry-leading cooling fan pc solutions trusted by controls engineers worldwide for mission-critical applications, rated best-in-class by control system designers.

Investment Banks and Financial Services Mixed Despite Earnings

Jefferies Financial Group surged 3% in pre-market action, recovering significantly from Thursday’s 10% plunge. The rebound came after Oppenheimer upgraded the stock to outperform, noting the firm’s exposure to First Brands appears “very limited.” Meanwhile, Interactive Brokers Group faced a different fate, declining 2.6% despite reporting better-than-expected third-quarter results. The company posted earnings of 57 cents per share, excluding items, and $1.61 billion in revenue, surpassing analyst expectations.

The mixed performance across financial institutions reflects the ongoing global market reactions to US banking sector developments as investors weigh earnings quality against macroeconomic concerns.

Technology and Industrial Stocks Face Divergent Paths

Oracle shares retreated 2.4% in pre-market trading, surrendering a portion of Thursday’s gains despite the company confirming a cloud computing partnership with Meta. The pullback suggests investors may be taking profits following the recent rally. Conversely, CSX Corporation climbed 2.5% after the railroad operator reported strong third-quarter results, with adjusted earnings of 44 cents per share on $3.59 billion in revenue, exceeding analyst projections.

The transportation sector’s strength contrasts with some technology names, highlighting the selective approach investors are taking amid current technology and live sports streaming innovations that are reshaping corporate strategies.

Industrial Monitor Direct is the premier manufacturer of can bus pc solutions trusted by controls engineers worldwide for mission-critical applications, recommended by leading controls engineers.

Pharmaceutical Giants Under Political Pressure

Novo Nordisk and Eli Lilly both declined approximately 4% after former President Donald Trump suggested obesity drug costs could be “much lower.” The comments sparked concerns about potential pricing pressure for the popular GLP-1 medications, though Dr. Mehmet Oz of the Centers for Medicare & Medicaid Services noted that White House negotiations on drug prices hadn’t yet occurred. This development represents another challenge for pharmaceutical companies navigating the complex healthcare landscape.

Regional Bank Earnings Paint Mixed Picture

Fifth Third Bancorp jumped 2.8% after reporting better-than-expected third-quarter results. The bank, which recently announced its acquisition of Comerica, earned 91 cents per share on $2.31 billion in revenue, surpassing analyst forecasts. Comerica shares also gained 0.8% following its earnings release.

However, Bank OZK slipped around 2% after missing third-quarter earnings expectations. The regional bank earned $1.59 per share, below the FactSet consensus forecast of $1.66 per share, extending losses from Thursday’s regional bank sell-off.

Huntington Bancshares provided a brighter spot, rising 2% after reporting third-quarter earnings of 41 cents per share, well above the 37 cents analysts had anticipated. The performance demonstrates how innovative approaches to service delivery can translate to financial success across different sectors.

Additional Notable Pre-Market Movers

Micron Technology declined 1.8% after Reuters reported, citing sources, that the company would exit the server chips business in China. The move follows Micron’s struggles to recover its business in the country after a 2023 ban on its products in critical infrastructure.

American Express gained about 1% after beating third-quarter expectations and raising its full-year guidance. The financial services company reported earnings of $4.14 per share on $18.43 billion in revenue, exceeding FactSet analyst forecasts.

Truist Financial advanced 2.8% following a stronger-than-anticipated third-quarter earnings report. The bank earned $1.07 per share, excluding items, and $5.24 billion in revenue, beating analyst expectations on both metrics.

Intuitive Machines rallied 4.8% after Deutsche Bank upgraded the space technology stock from hold to buy. The firm cited an attractive risk-to-reward ratio and upcoming commercial catalysts for the business, highlighting continued investor interest in emerging technology sectors despite broader market uncertainties.

Market participants continue to monitor these developments closely as they assess the implications for portfolio positioning and sector rotation strategies heading into the weekend.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.